Advantages of Big Data for Businesses in 2020 and Beyond

Living in 2020, we can proudly say that we live in the age of information. Data is the ruler of the world right now, and those who can utilize it to the max will stay ahead of the competitors.

It is important for every company and organization, size doesn’t really matter here - everyone needs timely insights derived from the information to achieve their goals, that’s where Big Data comes into play.

What is Big Data?

To put it simply, Big Data is the name of all processes, software, and tools that are accomplishing managing big sets of data. This idea was born out of necessity to understand patterns in the gigantic databases generated when customers interact with various systems and each other. Without a shadow of a doubt, Big Data is an important factor in creating new products, services, and experiences.

Why Big Data is important?

This can be a defining advantage for new innovative companies to compete with the leaders of the market, who haven’t utilize it yet. The size of the business or even the industry doesn’t really matter, because everybody has some kind of information, and that means that valuable insights could be derived from it.

Talking about the global revenue of the technology, the usage of Big Data is expected to generate 274.3 billion in 2022 worldwide, with the USA being the largest country on the market generating approximately the third of that sum. No wonder, because in the last few years more data was generated than in entire human history. In fact, every human right now is generating 1.7 megabytes of information in second. Can it be used for business advantage? Absolutely!

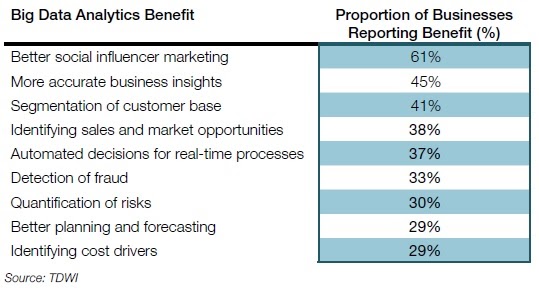

How does Big Data benefit a business?

Boosting revenue

Probably the most important reason to use Big Data for companies, as more than half of the organizations giving a chance to this technology solely for this, according to surveys. That’s because information by itself can transform into another income generator. Take a look at American Express, which takes over a quarter of credit card transactions in the United States of America, interacting with both businesses and their clients. Amex introduced the service for businesses that provide tools for online trend analysis and comparison among competitors. This functionality brings even more clients to the company, which results in the increased bottom line.

Big Data can also help companies save money. Speaking of American Express - their fraud-detection technology helped to save billions of dollars on securing credit card transactions. According to surveys by NewVantage and Syncsort, Big Data Analytics helped almost 60% of respondent-companies to save money in various areas and cases.

Better business decisions

It’s time to get rid of assumptions or feelings - Big Data provides facts you can take rely on, of course, if you have access to the information. Data must be accessible not only for BA’s and IT teams but for every business executive in the entire organization, so they can answer the most important questions fast. This approach with accessible information in the company is known as data democratization. Walmart is a great example of this strategy in action, providing their non-tech coworkers with the information-driven insights with a Walmart’s Data Café analytics hub. With this solution, employees can quickly identify mistakes in pricing and stock, as well as other issues.

36.2% of companies, that had been interviewed by NewVantage, claimed that the sole reason they invest in the best Data Analytics is improved decision-making, while 59% of already confirm it to be successful.

Improving customer experience

You constantly heard that Google knows everything about you, that’s what helps the company to show relevant ads that will target the right audience. It is possible thanks to a large amount of available information and the right analytics of it. This is a perfect example of technology in action. Another great case is a MagicBand at Disney’s theme parks. This device is a wrist band, used as an ID, keys and even devices for payment. They gather the information and help to personalize the experience, like personnel and Disney characters calling you and your family by the name

Smarter products and services

Being aware of the actions and habits of your customers will undoubtedly drive you to offer better services and products. Royal Bank of Scotland, shortly RBS, is a prime example of harnessing the knowledge about its client base to help them save time and money. The system is making sure that the client won’t pay for the insurance, for example, that was already included in other financial products, doing it in real-time and providing additional tips on every operation based on data. This approach may not seem like an instant income booster, however, it builds customer loyalty which will result in a great future for the organization in the long run.

More precise business operations

For the manufacturing industry automation is far from a fresh concept, however with the rising popularity of Big Data is taking this concept to other industries as well. Chatbots are already in the full force in the Retail industry, and of course banking and Finance. Powered by real-time access to data, they could adjust their performance and provide better results. Leveraging Robotic Process Automation (RPA), routine and simple tasks could be easily delegated to machines, freeing up time for interesting and sophisticated tasks to human experts. Big Data-based automation will definitely improve the quality and pace of business operations, giving machines a chance to do things they can do better than humans.

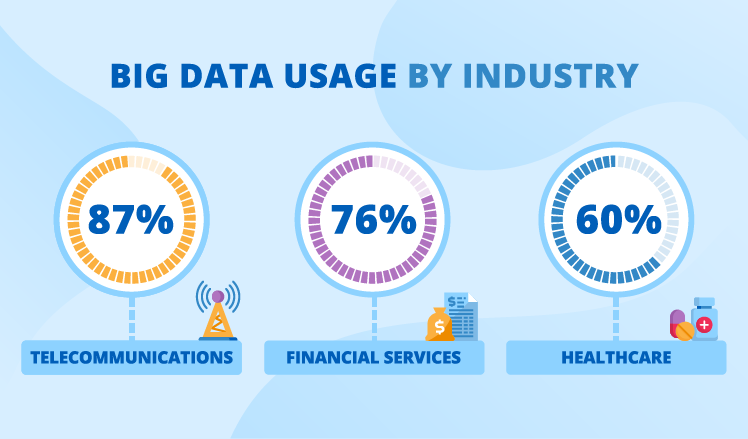

What exactly Big Data could bring to specific industries?

Everybody from influencers to researchers agrees that big data is set to make a big impact in almost every industry, extracting even more value in the coming years. Let’s examine the best examples.

Banking & Finance

Modern banking is driven by personalization, and 81% of executives surveyed by Oracle, believing that it’s possible to improve it by IT cloud development. Large banks and financial institutions are using Big Data for trade analytics, including sentiment measurement and Predictive Analytics. Personalization and improvements in internal processes lead to up to 18% of revenue increase for these industries annually!

Healthcare

According to McKinsey, Big Data can save up to 17% of Healthcare costs. Hospitals and healthcare services are already implementing technology in various ways across the globe. The University of Florida used free public health information and Google Maps to visualize the spread of chronic diseases.

Manufacturing

While this industry is one of the leaders in automation it still has enormous volumes of unprocessed information that could be used for the improvement of product quality, savings on energy, and better revenue. One precious-metal manufacturer investigated sensor information using Big Data solution to identify what caused ore grade decline. It turned out to be an oxygen level, the manufacturer solved this issue and earn $10-20 million more each year.

Retail

E-commerce traders, wholesalers and good old brick and mortar stores have one thing in common - an impressive amount of information that is being constantly collected. The retail industry could benefit using Big Data by optimizing staffing through information from shopping patterns, significantly reduce fraudulent transactions and provide accurate analysis of inventory. Adjusting social media marketing campaigns is another great way to implement it, which will boost customer loyalty and brand awareness.

What you can achieve by combining Big Data and Machine Learning?

Machine Learning is one of the best technologies to get the most out of Big Data. ML, a subdivision of Artificial Intelligence, is a data analysis process which uses algorithms to iteratively learn from information and find insights without even being specifically programmed to do it. Here is what Big Data powered by Machine Learning could bring to companies:

- Simplified product marketing - ML could provide more accurate sales forecasts, based on the obtained information, predicting the demand based on past customer behavior.

- Simplified documentation - inaccuracy and duplication are the two biggest barriers for data automation, which could both be dealt with ML algorithms.

- Precise and secure financial models - ML can improve portfolio management, provide secure credit card transactions, loan underwriting and probably the most important for financial institutions - fraud detection. All anomalies could be detected fast and dealt with right on the spot.

- Predictive Maintenance - ML can offer cheaper and effective Predictive and Preventive Maintenance solutions for companies in the Manufacturing industry.

Of course, there are way more benefits than these, depending on a business case. SPD Group is a company with impressive Artificial Intelligence and Machine Learning expertise that can provide you a consultation on specific advantages your business can get using ML and Big Data, as well as developing solutions for your company.

Why Legacy Systems are the biggest bottleneck to Big Data implementation?

That’s simple! Legacy Systems lack the functionality to connect all of your assets and implement necessary technological solutions to get the max out of your information. So, the first thing you should do to implement Big Data is to consider replacing your obsolete systems!

Conclusion

The future for Big Data for business looks very bright. As of right now 99,5% of collected information never gets used, meaning that we had only scratched the surface of what is yet to come, with the advancements in analytics.

Photo by Pixabay