PayPal Business Account Guide

Whether you’re on the hunt for a way to turn your hobby into a legitimate business or you’re a seasoned vendor looking to expand and grow, figuring out how to get paid in a way that’s quick, painless, and affordable is one of the most important operational problems you’ll need to solve.

Processing online payments, in particular, is especially critical. Over half of Americans now pay their bills online. And in early 2019, sales from online stores eclipsed those of general merchandise stores for the first time.

The good news is that just as e-commerce has revolutionized the way people buy and sell goods and services, it has also forever altered the way people conduct business online, with new solutions making accepting and processing payments easier and more frictionless than ever.

PayPal is far and away one of the pioneers in the space. Chances are, you’ve already used the online payment provider to make a purchase in the last few years.

What you might not know, however, is that the organization launched a merchant services wing in the early 2000s that not only gives business owners of all sizes the power to get paid faster and easier, but that also helps companies big and small grow and scale.

What is a PayPal business account?

PayPal is one of the most well-known online payment service providers (PSPs) in the world. A PayPal business account makes it fast and easy for businesses just getting started, as well as those that are more established, to accept and process credit card payments, debit card payments, and more in over 25 currencies and from over 200 countries.

Like competitors Square and Stripe, PayPal works by taking a small percentage of transactions made using their platform.

It’s also super simple for your customers to check out and make purchases via a PayPal business account. They don’t necessarily need to have a PayPal account themselves (they can do their shopping as a guest), and they can choose to pay via any of the following methods, both online or in person:

- Credit cards

- Debit cards

- PayPal

- Venmo

- PayPal credit

The credit and debit cards PayPal business accounts accept

| Credit cards accepted by PayPal business accounts | Debit cards accepted by PayPal business accounts |

| Visa | Visa |

| Mastercard | Mastercard |

| American Express | |

| Discover | |

| JCB | |

| Diner’s Club |

Related: Transferwise vs. Paypal: Which is better for Your Business?

Private label cards, like department store cards, and procurement cards aren’t accepted.

Debit cards that aren’t Visa or Mastercard and require a numeric password are also not accepted.

Thanks to PayPal’s history — it was acquired by eBay in its early days — it’s also generally regarded as one of the most robust PSP solutions for e-commerce businesses. It integrates with hundreds of commerce platforms, including both specialty online marketplaces like eBay and Swappa as well as custom online stores like WooCommerce and Magento.

And for those on-the-go or brick-and-mortar vendors that still primarily accept payments in person, a PayPal business account offers PayPal Here, which provides business owners with a mobile app and an assortment of card readers.

Beyond just solving the core operational problem of getting paid, however, a PayPal business account also helps business owners manage and scale their companies.

The PSP has expanded the services they offer over the years to include everything from a launch kit for newbies and shipping help for those that need to deliver products, to lending options for veterans looking to grow their career opportunities and even reporting for those that want to better understand where they’re succeeding and where they have room to improve.

Types of PayPal business accounts

A PayPal business account comprises two overarching payments processing options for business owners:

PayPal Payments Standard. This basic PayPal business account account doesn’t charge a monthly maintenance fee and allows account holders to accept all of PayPal’s payment methods (except for payments made via phone, fax, or virtual terminal). It also includes the standard PayPal business account benefits, like toll-free phone support and simplified PCI compliance functionality.

PayPal Payments Standard is ideal for business owners just getting started as well as those who are more than happy with a no-frills checkout option on their website or via their e-commerce platform provider. Customers are taken to PayPal’s site to complete payment and returned to the business’s site afterward.

PayPal Payments Pro. A step up from its standard counterpart, PayPal Payments Pro includes all of the perks that come with the basic account as well as the ability to accept payments via phone, fax, or virtual terminal.

This account also gives business owners complete control over their checkout pages, which makes it ideal for those who really want to take their e-commerce site to the next level. Customers never leave the business’s site when making a payment.

Unlike PayPal Payments Standard, this option comes with a monthly maintenance fee of $30.

Additional PayPal business account merchant services

A PayPal business account also includes a suite of services beyond payment processing. Some of these are included in the accounts outlined above, like invoicing and eligibility for a PayPal debit card, but other features require an additional application process or development work.

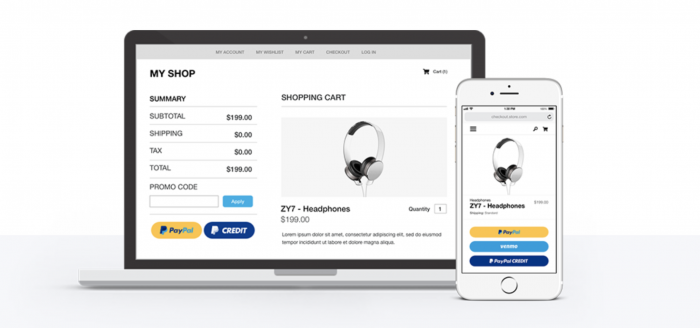

PayPal Checkout. In a nutshell, PayPal Checkout adds Smart Payment Buttons to your e-commerce site that allow users to buy your goods and services with one click, bypassing a tedious order process that involves long, complicated forms. PayPal then provides you with the customer’s contact information and shipping address, if appropriate.

PayPal Business Loans and Working Capital. Cash flow is one of the primary problems a growing business faces. With PayPal Business Loans and Working Capital, the PSP makes it relatively simple for companies with a PayPal business account to get the funds they need to keep expanding.

PayPal Marketing Solutions. Like the complimentary invoicing, shipping, and debit card options that come with PayPal Payments Standard and Pro accounts, PayPal Marketing Solutions is baked into the offering. This valuable suite of features includes insights into how often your customers are shopping, how much they’re spending, and how they’re interacting with your checkout experience. To enable this service, all you have to do is copy and paste a snippet of code onto your website.

7 benefits of a PayPal business account that you should know about

No monthly maintenance payments

Far and away one of the best perks of a PayPal business account is that the standard account comes with absolutely zero monthly maintenance charges. That means that there’s no cost to sign up and start accessing all of the merchant services on offer.

There are also no setup or cancellation fees. You’ll only be charged when you actually start doing business (see the chapter on PayPal business account fees), which means you can spend your time — and your extra cash — on the other business services that matter.

Lightning fast setup

It takes as little as 15 minutes to get up and running with a PayPal business account. Since the registration process is completely digital, you can go through the quick and easy online steps wherever and whenever you want. There’s no waiting in line at the bank, and you won’t find yourself on the other end of a frustrating phone call that mostly consists of bad hold music.

Low barriers to entry

Unlike old-school merchant account providers that often come with complicated qualifying terms and heaps of paperwork, a PayPal business account merely requires some basic contact information and general details about your company. Anyone can sign up — a credit check isn’t necessary. You merely need to link a bank account in order to receive funds from your transactions.

Get paid online or in person, in the U.S. and from abroad

Another huge perk is that a PayPal business account is flexible when it comes to accepting payments. Customers can pay with major debit and credit cards as well as PayPal, Venmo, and PayPal Credit (they don’t even need a PayPal account). What’s more, people can make purchases online, in person, or even via invoicing. Finally, PayPal makes it possible to do business over borders and even across language barriers — it’s available in 25 currencies and across 200 countries.

Easy e-commerce integration

A PayPal business account syncs with hundreds of solution providers and shopping carts. Most major providers and even many of the smaller players have a simple option in their admin console where you can select the PayPal integration and enter your login details and relevant credentials — it’s that easy.

Get cash back with the PayPal business account debit card

Sick of all the dead-end debit cards that don’t give you any incentive to actually spend the hard-earned money you’re making? Then you’ll be happy to know about PayPal Business Debit Mastercard, which comes complimentary with an account (you just need to request the card) and gives you 1 percent cash back on eligible purchases.

You can use the card to immediately access all the funds in your PayPal account without having to transfer anything to your business bank account, whether you’re withdrawing from an ATM or making an in-store purchase (the card works anywhere that accepts Mastercard).

Leverage discounts for nonprofits and charities

The PayPal business account also offers special, cheaper transaction rates for registered 501(c)(3) organizations. The organization even has a ready-to-roll donate button that anyone doing fundraising can quickly and easily add to their website once they’ve created a PayPal business account.

As a bonus, PayPal has done the legwork to integrate with popular fundraising sites, like FundRazr, so that it’s easy to activate their services and start accepting the money you need.

Who needs a PayPal business account?

You may have heard stories about many casual sellers launching booming businesses from their personal PayPal accounts over the years. So it wouldn’t be surprising if you’re wondering what the difference is between a PayPal personal account and a business account — and why a sole proprietor or small business owner should consider opening one or the other.

In a nutshell, PayPal’s personal account is designed primarily for purchasing and sending money. All that’s required is for you to provide contact information and a verifiable bank account. On the flip side, while you can receive funds from other PayPal users, you won’t be able to accept as many types of payment, nor will you be able to extend access to your account to employees or colleagues or take advantage of business-targeted services such as PayPal Checkout or PayPal Marketing Solutions.

In addition, opening a separate PayPal business account will prevent you from mixing up personal purchases with business expenses and personal monetary gifts from business revenues. If you’ve gambled on being able to track everything through your personal account and your side business suddenly takes off, you’ll spend hours extricating personal transactions from business transactions at tax time, and the stakes for making a mistake could be high.

Since phasing out its Personal Premier accounts, PayPal’s business account has become the most sensible account option for even the smallest businesses, including freelancers and small-scale artisans. Nearly anyone who plans to collect revenue or distribute money for business purposes will benefit from opting for a business account rather than a personal account.

From increased access to a variety of payment options, to customer support, to analytics and tracking, the business account is designed to help your small business grow into a mid-sized business. And for a $30 monthly fee, PayPal Payments Pro is ready to help you grow further with scalable benefits and services.

Here are a few types of businesses that can benefit from a PayPal business account.

Freelancers and entrepreneurs with a sole proprietorship

PayPal suggests using a business account if you operate a revenue-generating endeavor under a separate name — for example, if you’ve set up an LLC. However, there are legitimate reasons why successful freelancers and sole proprietors might want to consider opening a business account even if they haven’t yet registered a formal business and chosen a company structure.

PayPal business accounts allow you to integrate your payment systems with their payout system to create a seamless accounting system you can use to easily monitor sales and profits as well as expenses. Opening a separate PayPal business account will make it easier to calculate profits and expenses when it comes time to file taxes.

One of the most compelling reasons freelancers may want to consider using a PayPal business account is that it can expedite payments from clients, with transactions often taking only minutes. Even for artisans or vendors who do business in person, frequenting craft fairs, farmers markets, and flea markets, a business account provides integrated swiping, online payment, and credit card processing systems, and even tracks receipts for you (you just need to activate PayPal Here).

The risks for opening an account are low since there are no startup, termination, or monthly fees. As far as transaction charges are concerned, they are the same whether you receive payment through a personal account or a business account.

Moonlighters and side hustlers

If you’re trying to transform a passion into a profit-making business, using your free time to raise income through a side hustle, or looking to get a business off the ground while still working long hours in a more conventional staff position, you likely don’t have much spare time to devote to bookkeeping.

So it’s unlikely you have the time to untangle information from a personal PayPal account. Separating personal monetary gifts from customer transactions and personal purchases from business-related expenses at tax time is likely to be confusing, frustrating, and a waste of time.

With no upfront or monthly fees, setting up a separate PayPal business account, or adding one if you already have a personal account with PayPal, is a sensible solution for hard-working, aspiring entrepreneurs who still have one foot in the wage-earning world.

The PayPal Payments Standard account will track customer receipts for products or services purchased, as well expenses paid to contractors you hire or products you purchase to get your new business up and running.

By keeping your business and personal accounts separate, you spare yourself the confusion and tediousness of sifting through transactions to determine which are personal and which are related to your side business.

Vendors on eBay and Etsy

Originally acquired by eBay back in 2002 before it spun off to go it alone again in 2015, PayPal was once the go-to system for transactions on the popular online marketplace.

That said, if you’re asking yourself, “Do I need a PayPal account to sell on eBay?” the answer is technically no. It’s possible to opt into eBay’s Managed Payments service, which allows you to receive funds directly into your bank account.

However, PayPal remains the simpler and faster of eBay’s accepted payment options, which means that those who currently use PayPal don’t need to do anything to receive customer payments through their PayPal business accounts and can, as was the case before, expect a super seamless experience that’s incredibly safe and efficient.

So while you don’t necessarily need a PayPal business account to sell on eBay, it can simplify your operations.

Similarly, if you’re a creative who’s created a nice little cottage industry hawking your inventions and projects on Etsy, you’ll be happy to hear that PayPal is an automatic option if you’re using Etsy Payments. And even if you’re not, you can easily configure your payment settings to accept PayPal payments.

Small businesses (SMBs) and startups with an LLC

If you’ve set up a limited liability company (LLC) for your small businesses to protect your personal assets, opening a PayPal business account can extend your customer base and deliver more marketing value.

According to data collected by comScore, customers complete 88 percent of initiated checkouts on PayPal. Consumers using other digital wallets failed to purchase items they’d saved to shopping carts 44.7 percent of the time.

And PayPal’s mobile payment options can expand the viability of small businesses, allowing them to keep up with a growing digital marketplace. (In 2019 nearly 80 percent of consumers reported using a mobile device to make a purchase.)

If your company upgrades to PayPal Payments Pro, your customers can remain on your website to complete transactions on your own dedicated payment page with your branding. When your customers don’t have to leave your site to make a payment, they’re more likely to continue shopping.

Corporations

PayPal business accounts allow access to up to 200 employees. You can set a variety of access levels to protect your customers’ privacy and your business interests. PayPal also allows you to set up a separate email for customer service issues.

PayPal business accounts include setup support and business consulting, including customer analytics, with a range of benefits and enhancements at the Payments Pro level that are designed to scale to your business as it grows.

PayPal can accept payments in 25 forms of currency and from more than 200 countries. You can also use PayPal to set up subscriptions and other forms of interval payment, as well as customized invoicing.

The standard amount you can transfer in a single transaction is $10,000, but you can increase this limit by contacting PayPal and providing certain verification information. Though PayPal aims its services at small and mid-size companies, several large online retailers use PayPal as a payment option for their customers, and for businesses that rely on a high volume of payments of less than $10 each, PayPal offers a special micropayment fee structure.

If your business has the good fortune to generate large amounts of income through sales, then PayPal’s per-transaction processing fees can add up quickly. In this case, you may need to look for another online transaction solution that offers a flat rate or work with PayPal to create an individualized fee structure. The PSP has stated that they’re committed to scaling their products to grow their customer base.

PayPal isn’t designed for businesses that rely on frequent large transfers of cash from vendors to other business partners.

PayPal business accounts for nonprofit organizations

PayPal has become an important part of the nonprofit landscape, with more than 1 million users donating over $106 million via PayPal on GivingTuesday 2019 alone. Those donations, like all donations made in December 2019, were augmented by 10 percent from the PayPal Giving Fund. The rest of the year, PayPal’s Giving Fund kicks in 1 percent on every donation toward whatever verifiable 501(c)(3) charities users designate.

PayPal’s low costs, relatively fast transactions, reputation for reliability and security, and vast pool of users can all be leveraged to fuel charitable fundraising. In many cases, donation dollars show up in your organization’s account within minutes. From there, you can transfer money to your organization’s bank account at no charge. More than 600,000 nonprofits already receive funds through PayPal.

Fees for nonprofits

Registered charities with 501(c)(3) status pay a reduced per-transaction rate of 2.2 percent plus 30 cents for U.S.-based donations, and 3.7 percent plus a fixed fee for international donations.

Donor tracking and access

Creating a PayPal business account and enrolling in their Giving Fund can help your organization tap into the payment platform’s growing segment of donors, including the 8 million users who donated to charities in 2017.

What’s more, monthly statements and searches allow you to easily track and leverage donor information. There are also options that allow donors to sign up for recurring monthly donations.

According to a survey conducted in 2014, 28 percent of PayPal charitable donors said they wouldn’t have made their donations if PayPal hadn’t been among the payment options.

Secure donor transactions from anywhere

Using PayPal Here, you can accept payments onsite at fundraisers using a mobile device. With a standard account, your nonprofit organization can get, at no extra charge, up to five basic credit card-reading attachments (though more advanced card readers with additional security are recommended for nonprofits that expect higher volume donations) or three chip and swipe readers that can be used with a smartphone or tablet.

The information donors provide at the point of sale can be automatically integrated into your donor contact list. And you can help keep this information secure by setting user permissions so that volunteers and employees can complete only specific tasks.

PayPal has also partnered with a variety of national and international applications and online resources aimed at the not-for-profit sector, which means that enrolling in their solutions for nonprofits can extend your reach to donors throughout the world.

Services and benefits

Like all PayPal business accounts, nonprofits can access free, seven-day-a-week customer support. Your organization will be eligible for a PayPal Business Debit Mastercard, which allows you to earn 1 percent cash back on expenses.

Even if you opt not to open a PayPal business account, you can enroll in the PayPal Giving Fund, giving potential donors the opportunity to allocate funds to your organization using eBay, Go Fund Me, Humble Bundle, and other online applications when they purchase items using PayPal. Once you’re enrolled, the PayPal Giving Fund will manage tax receipts for your donors automatically.

Nonprofit partnerships

PayPal has partnered with some of the most recognized platforms in the nonprofit sector to expand the reach of nonprofits to online donors, including the digital transaction solution Paperless Transactions, the online fundraising platform FundRazr, fundraiser management software provider Classy, marketing and constituent engagement system BlackBaud, donor management and fundraising software Network for Good, and eBay.

Each of these solutions allows you to set up PayPal as your preferred transaction provider and integrates your business account into their platform for easy use by staff, volunteers, and donors.

PayPal business account requirements

Among the advantages of a PayPal business account are the relatively few requirements and the absence of up-front fees. There are no minimum capital or sales volume requirements either, making it an attainable next step for sole proprietors or small businesses looking to extend their range and increase their clients’ payment options.

Getting started: What you’ll need to open a PayPal business account

If you don’t have a separate bank account for your business, you should consider setting up one before you set up a PayPal business account.

You can use your personal account, but it’s best to have at least two bank accounts as you begin your entrepreneurial endeavors on PayPal — one personal and one for your business. This will make it much easier to track payments and business expenses, complete your taxes, and gauge your business’s rate of growth.

Once you have both your personal and business bank accounts in place, you can sign up for a PayPal business account in a few simple steps.

As with a PayPal personal account, you’ll need to confirm your email address, provide contact information, and provide account information for the bank account where you’d like the money to be deposited; a designated business banking account is recommended but not required.

You’ll need to provide a business name that will appear on customer invoices. And you’ll be asked to describe the type of business you have by selecting from a dropdown list:

- Individual/sole proprietorship

- Partnership

- Corporation

- Nonprofit organization

- Government entity

Depending on your business type, you may be asked for additional information, such as product or service keywords, monthly sales, website, and employer identification number. However, there are no wrong answers; you merely need to provide the information.

Finally, you’ll need to provide customer service contact information, which for a sole proprietor is likely to be you.

The costs of a personal and a standard, or first-level, business account are identical. Neither has startup or monthly fees, and both have identical transaction fees.

Frequently asked questions about PayPal business accounts

Do you have to be a U.S. citizen to open a PayPal business account?

In accordance with the 2010 Foreign Account Tax Compliance Act (FATCA), users opening a business account may need to provide tax documents and other verifying information to prove that they are a U.S. citizen or a non-U.S. citizen who is properly paying taxes on any monies collected or earned in the United States or from U.S. citizens.

In addition, to comply with FATCA, PayPal reviews personal accounts frequently, and when discrepancies are found, will request documentation of citizenry or lawful U.S. taxpayer status from account holders.

Is there a minimum income required to open a PayPal business account?

There is no minimum income or sales volume required to open a business account. However, to be eligible for PayPal Working Capital, you need to have a business account up and running for 90 days and process at least $15,000 in a 12-month period.

PayPal business account fees

If you want to start using PayPal for your business, it’s important to understand the PayPal business account fees associated with standard transactions and accepted payments online and in store.

Most important, there are no initial costs to get started or monthly costs attached to a standard PayPal business account. There are no termination fees either. Using a standard PayPal business account is best for businesses that want to save on fees and enjoy some flexibility.

If you want to offer a more robust customized and integrated shopping cart and checkout experience for your customers online, you may want to consider upgrading to a PayPal Payments Pro account. It costs $30 per month, along with the standard transaction fees.

PayPal business account transaction fees are only applied when you sell products or services and accept payments online or in store. Your business pays a standard transaction fee based on the percentage of the total transaction amount and the fixed fee of the currency for the respective country. Below is a breakdown of the percentages and fixed fees for online and in-store transactions in the U.S.

| Transaction types | Percentage of total transaction amount | Fixed fee amount |

| Online | 2.9% | $0.30 USD |

| In-store | 2.7% | no fee |

If you’re selling online or in store internationally, the percentage of the standard transaction amount increases slightly, and the fixed fee amount based on the local currency still applies to your total fees. Here’s a breakdown of the transaction percentages and fixed fees you might expect if doing business in Mexico:

| Transaction types | Percentage of total transaction amount | Fixed fee amount |

| Online* | 4.4% | 4.00 Mexican Peso |

| In-store | 4.2% | no fee |

*International sales made online incur an additional 3-percent currency conversion charge and a 1.5 percent charge for receiving a payment from a different country.

Your PayPal business account fees will vary according to the country you’re selling to and accepting payments from. This list of the countries and their currencies will help you calculate the fixed fee amount for your total transaction fees when selling products/services and accepting payments abroad.

Acceptable forms of payment include Venmo, PayPal Credit, PayPal payments, and all major credit and debit cards with PayPal Checkout and PayPal Payments Standard.

Reduced transaction fees for nonprofit organizations and charities

If you’re a nonprofit organization with 501(c)(3) status, you’ll pay reduced fees for credit card, debit card, or PayPal donation payments in the U.S. and internationally. Here are the transaction fees and fixed fees for a nonprofit organization:

| Location | Percentage of total transaction amount | Fixed fee amount |

| U.S. | 2.2% | $0.30 USD |

| Internationally | 3.7% | varies by country |

To qualify your PayPal business account for discounted transaction fees, you must verify your nonprofit organization’s charity status by providing your employer identification number (EIN) and proof of the nonprofit bank account linked to the PayPal account via bank statement or a voided check.

Other PayPal business account fees

Apart from the standard transaction fees attached to a PayPal business account, there are several add-on features that may or may not cost you. Here are some possibilities:

| Service type | Location | Percentage of total transaction amount | Fixed fee amount |

| Online invoice creation (doesn’t include fees associated with paying the invoice) | U.S. or International | No fee | no fee |

| Micropayments* | U.S. | 5.0% | $0.05 USD |

| Micropayments | International | 6.5% | varies by country** |

| PayPal Payments Pro ($30 USD monthly fee) | U.S. | 2.9%, plus 3.5% per transaction if using an American Express card | $0.30 USD |

| PayPal Payments Pro ($30 USD monthly fee) | International | 4.4% per transaction, plus 3.5% per transaction if using an American Express card | varies by country*** |

| Virtual Terminal ($30 USD monthly fee) | U.S. | 3.1% per transaction, plus 3.5% per transaction if using an American Express card | $0.30 USD |

| Virtual Terminal ($30 USD monthly fee) | International | 4.6% per transaction, plus 3.5% per transaction if using an American Express card | varies by country*** |

| Mobile Card Reader | Swipe and check-ins in the U.S. | 2.7% per transaction | no fee |

| Mobile Card Reader | Key or scan in the U.S. | 3.5% + $0.15 per transaction | no fee |

| Mobile Card Reader | Swiped non-U.S. cards | 2.7% per swipe | 1.5% cross-border fee and/or 2.5% currency conversion fee |

*Micropayments are transactions less than $10.

**Click here for micropayment fixed fee amounts by country.

***Click here for PayPal Payments Pro and Virtual Terminal fixed fee amounts by country.

PayPal bank account transfer fees and options

Transferring money to your bank account is easy as long as you have a U.S. PayPal account already set up and linked to your bank account. This transfer can be done through a personal or business PayPal account, and there are two options to consider:

- A standard transfer

- An instant transfer

Zero-cost Standard Transfers

If you’ve linked a bank account to your PayPal business or personal account, then you don’t have to pay a transfer fee. Transfers typically take one to three business days to be deposited. If you opt to complete a transfer on a weekend or holiday, it may take slightly longer for the money to show up in your account.

Costs for Instant Transfers

With Instant Transfers, you can transfer money from your business or personal account to your bank account or debit card in a matter of minutes. Keep in mind that transfers can take up to 30 minutes depending on your bank, and you do have to pay an additional fee for this service. The cost to use Instant Transfer is 1 percent of the total amount you transferred, up to a maximum fee of $10.

Eligibility requirements for transfers

Both standard and Instant Transfers require a linked and eligible bank account. Your bank is eligible if it’s part of the Clearing House Real Time Payments program. If you’re transferring funds to a linked debit card using Instant Transfer, your debit card must be a Visa or Mastercard to be eligible.

You can transfer to whichever linked account (bank or debit card) that you choose. Keep in mind that there could be a delay in your transfer if it’s subject to review, submitted after 7 p.m. Eastern time, and on weekends or holidays.

PayPal business account vs personal account withdrawal limits

If your business chooses to use Instant Transfer for your PayPal business account, there are withdrawal limits based on account type. Check out the withdrawal limits below:

| Withdrawal limit type | Withdrawal limit amount | Business account or bank |

| By transaction | $50,000 | business account |

| By transaction | $25,000 | bank |

| By day | $100,000 | business account |

| By week | $250,000 | business account |

| By month | $500,000 | business account |

If you want to use Instant Transfer for your PayPal personal account, below are the withdrawal limits on your debit card and bank:

| Withdrawal limit type | Withdrawal limit amount | Personal debit card or bank |

| By transaction | $5,000 | debit card |

| By transaction | $25,000 | bank |

| By day | $5,000 | debit card |

| By week | $5,000 | debit card |

| By month | $15,000 | debit card |

PayPal business account fees vs personal account fees

Opening a PayPal business account or personal account is free, unless you choose to upgrade your account. There are no startup costs, termination fees, or monthly maintenance fees for the standard version of these accounts.

The main difference between the two are the transaction fees. A business account will incur charges based on standard transaction fees and fixed fees from selling products or services online or in-store.

A personal account, on the other hand, charges transaction and fixed fees in the U.S. and internationally when you receive money from someone who uses a credit card, debit card or PayPay Credit. A personal account won’t charge fees if you receive money from someone using a linked bank account, PayPal Cash, or a balance from PayPal Cash Plus.

| Payment method | Location | Fees | Fixed fee amount |

| PayPal Cash or PayPal Cash Plus | U.S. | waived | none |

| Credit card, debit card, or PayPal Credit | U.S. | 2.9% of the total amount | $0.30 USD |

| PayPal balance or linked bank account | International | 5% of the amount sent, from $0.99–$4.99 USD | none |

| Credit card, debit card, or PayPal Credit | International | 5% of the amount sent, from $0.99–$4.99 USD, plus 2.9% of the transaction amount from a specific payment method | varies by country |

Also, transferring your money to your bank from a business account or a personal account is typically free, unless you use Instant Transfer. In this case, the withdrawal limits differ depending on whether you have a business account or a personal account.

The cost to buy in the U.S., however, is always free for either account type.

Frequently asked questions about PayPal business account fees

How much does it cost to start using my PayPal business account?

It’s completely free to get started. There are no startup costs, monthly fees, or termination fees.

What are the minimum fees I should expect to pay for my PayPal business account?

You should expect to pay the standard transaction fees for online and in-store transactions in the U.S. and internationally, and any fixed fees for the respective country. Find out more from the breakdown of costs above.

When doing business internationally, are there currency conversion costs involved?

Yes. You will be charged an additional 3 percent for currency conversions and a 1.5 percent fee if you receive payments from a different country.

How much does it cost to transfer money from my PayPal business account or personal account to my bank or debit card?

For a standard transfer, there are no costs. For Instant Transfers, which can give you access to your funds in as little as 30 minutes, the cost is 1 percent of the total amount you transferred, up to a maximum fee of $10. Keep in mind that there are withdrawal limits for your business account and personal account if you’re using Instant Transfer.

How to set up a PayPal business account

Ready to start accepting payments for your business with a PayPal business account? You can get up and running in just a few easy steps. Here is a step-by-step guide to help.

Setting up a PayPal business account

How to upgrade or downgrade a PayPal business account

How to delete and close a PayPal business account

How to use JotForm to sell products and collect payments

Now you have all the facts, and perhaps you’ve settled on a PayPal business account as your PSP. Maybe you’ve set up your account, and you’re ready to start watching your bottom line grow.

Alternatively, you may still be deliberating or comparing options. Regardless of where you are in the decision-making process, it’s important to remember that having the power to collect payments is only one small piece of the puzzle.

Another critical element is creating the infrastructure that will allow you to effectively market and sell your products and subscriptions, or collect donations and raise money online. This may feel especially intimidating if you’re not particularly web savvy.

Similarly, if you’re a microbusiness with limited resources or a nonprofit that’s always battling against time, you may not have much time to spare setting up an e-commerce site or learning the ins and outs of website development and design.

The good news is that JotForm offers a form building solution that makes it as easy to sell products as PayPal makes it to collect payments. The even better news is that you can create a PayPal payment form with JotForm, so it’s incredibly simple to get your goods in the hands of your customers and get paid!

This option is particularly useful for charities and organizations accepting donations, anyone putting on events, order-based businesses, DIY entrepreneurs, and even professional services providers. Truth be told, any business — big or small — can use JotForm’s easy online Form Builder to create order forms, recurring subscription forms, membership forms, and more in only a couple of clicks.

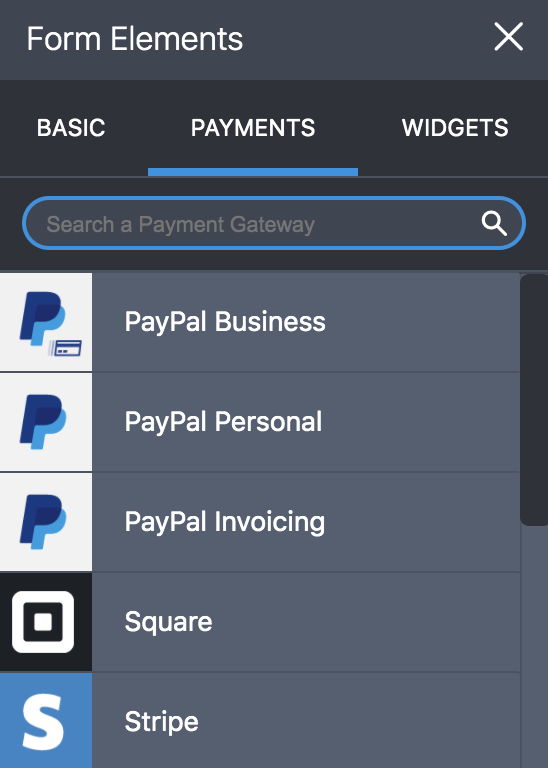

Then it’s just a matter of selecting either the appropriate PayPal Personal, PayPal Business, or PayPal Invoicing option from the Form Elements section in the JotForm Form Builder and completing the steps that follow.

JotForm not only makes it a snap to start selling your goods and services, but the uber popular form builder also doesn’t charge any extra transaction fees. PayPal’s standard fees apply as normal. The only fees you pay JotForm are for your account, unless you’re on a free plan.

And if that’s not enough to pique your interest, here are a few other great reasons to consider using a JotForm-PayPal business account integration to start selling and collecting payments:

- It’s flexible. JotForm gives you the ability to collect everything from payments for products with a specific price to recurring subscriptions to custom donation amounts.

- It comes at no cost. Not only does JotForm forego charging any additional transaction fees, the platform also offers a free account option that gives users the opportunity to accept 10 payments per month on the house. If you plan on accepting more, you can opt for any of the other JotForm plans.

- It’s as easy as 1-2-3. Anyone and everyone can use JotForm’s drag-and-drop Form Builder to put together nearly any kind of form. It’s beyond simple.

- No technical expertise needed. No code know-how required. You don’t need development knowledge to use JotForm, and thanks to the platform’s super robust Help section, even if you do run into a problem, there are resources and support available to give you the guidance you need.

- Thousands of templates. Among their 10,000 form templates, JotForm has templates made just for PayPal.

- End-to-end customization. From adding your own branding to uploading an image to make your form look friendlier, JotForm’s Form Builder makes it a breeze to customize templates. And if you do have some engineering skills, you can even add CSS to create the kind of forms your customers or donors will love.

- PCI compliance. When the risk of cyberattacks and fraud seem to be increasing daily, customers want to know your website is secure. JotForm provides both your business and the people supporting it with the highest level of security protection.